Key trends influencing the semiconductor industry through 2025

Written by editor James Bourne

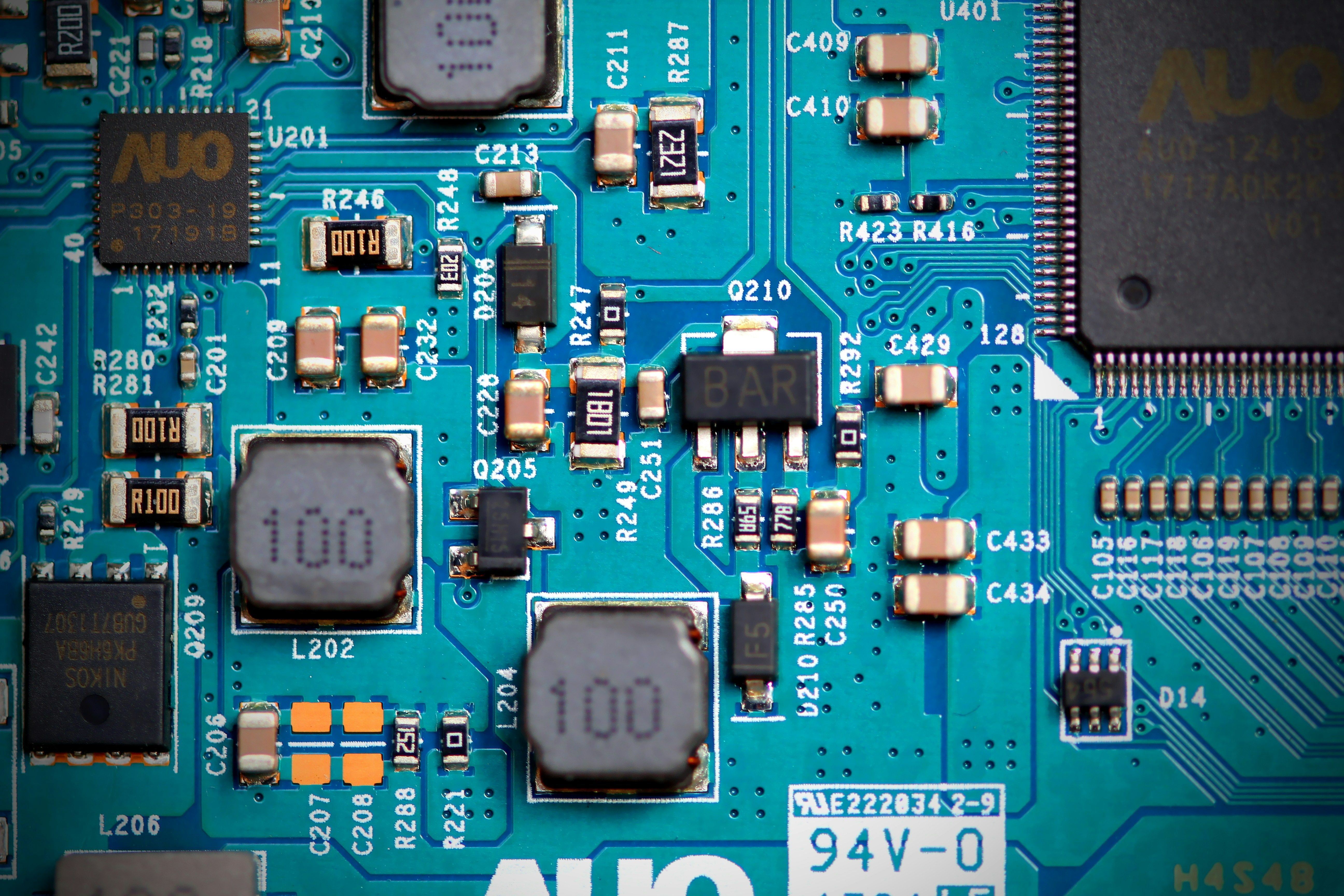

The global semiconductor industry appeared in sound health going into 2025. Gartner posited that worldwide revenues for 2024 totalled $626 billion at an uptick of 18.1% from the previous year, projecting total revenues of $705bn for 2025. The World Semiconductors Trade Statistics (WSTS) organisation, meanwhile, had it at an almost identical $627bn, citing improved second and third quarter performance as key. Both memory and logic components will see double-digit year over year growth in 2025, according to the trade body.

What is driving this growth? Inevitably, generative AI has plenty to do with it. Gartner notes that generative AI workloads meant data centres were the second largest market for semiconductors last year, behind only smartphones. PwC, in its most recent State of the Semiconductor Industry report, notes that the “demand for faster, more efficient memory solutions will rise… bolstered further by the growing adoption of AI, IoT, and cloud computing across industries.”

So what trends are currently being seen – and what can we expect to see in the industry going forward?

Generative AI for chip design

Generative AI is not just influencing the workloads for which semiconductors are being utilised; it is also influencing the design and development process itself. Generative AI is able to automate various parts of chip design, as well as generate test scenarios and other routine tasks.

For chip design, deep learning has played a vital role in creating optimal circuit designs where design space is most efficiently utilised. It is an extremely hot area among the world’s largest tech companies.

NVIDIA’s PrefixRL model, as far back as 2022, was designing 25% smaller circuits to improve workflow. Last year, Samsung followed suit by using AI software from Synopsys to design its Exynos chips. Synopsys, as a provider of electronic design automation (EDA) works with many of the leading tech providers, and has collaborated in particular with Microsoft, to not just utilise Azure’s cloud heft but also roll out Synopsys.ai Copilot, with the goal to make ‘every designer… take their productivity up across every phase in the chip design cycle.’

Google, announcing its AlphaChip design technology in September, claimed that it could design ‘superhuman chip layouts’ in hours, as opposed to weeks of human endeavour. The idea was to approach chip floorplan design as like a game, much as AlphaGo did, where reinforcement learning plays a big part. “A novel ‘edge-based’ graph neural network allows AlphaChip to learn the relationships between interconnected chip components and to generalise across chips, letting AlphaChip improve with each layout it designs,” the company noted.

Sustainability

According to a study published in the journal Water Cycle, in 2021 the semiconductor industry used enough energy to power a city of 25 million for a whole year. McKinsey notes that semiconductor companies need to focus on the three S’s for new site builds: sustainability, supply chain security, and subsidies.

Manufacturers have therefore moved to make their offerings more sustainable. Some of this is through legislation, such as the European Water Resilience Strategy, which SEMI, the industry association for the global electronics design and manufacturing supply chain, recently described as a ‘positive and fundamental step’ for greater water efficiency, resilience, and sustainability.

Others are more by design, such as developing chip architectures which prioritise energy efficiency. Industry analyst Michael Sanie summed up the opportunity in a February post. “Semiconductor manufacturers, cloud hyperscalers, and chip designers are in a full-scale race to build the most energy-efficient processors,” he wrote. “The companies that win this race will dictate the future of AI, cloud computing, and mobile technology – and the investment implications are enormous.”

Partnerships have also come to the fore. Take TSMC (Taiwan Semiconductor Manufacturing Company) as an example. The world’s largest dedicated independent semiconductor foundry, which committed to100% renewable energy usage in 2020 and accelerated its timeline in 2023, has inked major deals with both Orsted and ARK Power. An article from Schneider Electric outlines the importance of partnerships in decarbonising the semiconductor industry, through resource sharing and innovation acceleration.

Chiplets

The shift from monolithic system-on-a-chip (SoC) architectures to chiplet-based designs, with the limitations of the former, is becoming increasingly apparent. Breaking the SoC apart into composite functional blocks has immense potential, as an IBM post explains. “A system comprised of chiplets is… like an SoC on a module, and, in the future, could be made using interoperable mix and match chiplet components sourced from multiple providers.

“This approach could lead to chiplets powering entirely new computing paradigms, creating more energy-efficient systems, shortening system development cycle time, or building purpose-built computers for less than it would cost today.”

The automotive industry is a particularly strong example of where chiplets can be effective. Arm points out that key automotive use cases, like advanced driver assistance systems, autonomous driving, and in-vehicle infotainment, require a heterogeneous compute approach – but monolithic builds are too complex and costly. The Automotive Chiplet Program (ACP), driven by the Interuniversity Microelectronics Centre (imec), aims to provide standardisation. Arm and Cadence are among the members, with the two companies collaborating separately on a chiplet-based reference design and software development platform to speed up time to market for software-defined vehicles.

“This transformation is about technological advancement and setting the stage for a new era of innovation across various sectors,” wrote Steve Brown, marketing communications director at Cadence.

Other generative AI applications

There are various other ways in which generative AI is touching the semiconductor value chain. Semiconductor companies can crunch datasets, from market trends to the geopolitical landscape, to more proactively guard against future headwinds. One such example, albeit at the extreme end, was the global chip shortage fuelled by the Covid-19 pandemic.

Accenture, in its ‘Breaking Barriers, Building Connections’ report, outlines use cases in which semiconductor companies can generate value, from manufacturing, to sales and marketing. For the former, genAI-enabled field service assistants can recommend repair methods to engineers based on machine data, while as a more strategic bet could be around automating wafer defect detection. For sales, generative AI-enabled marketing campaigns can have real-time content updated based on production yields and R&D innovations.

“Low-risk, high-value generative AI applications that companies can deploy quickly are available today,” the Accenture report notes. “Quick wins can be used to generate momentum across the value chain and even across ecosystems. Successfully deploying these applications, however, depends on having the right talent in place.”

)

)

)

)

)